refund for unemployment taxes paid in 2020

However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

The American Rescue Plan ARP signed by President Joe Biden in March excluded up to 10200 in 2020.

. The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Some taxpayers will receive refunds that will be issued periodically and some will have the overpayment applied to taxes due or other debts. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. The Internal Revenue Service said Nov.

The IRS has not announced when the next batch will be sent out but. For some there will be no change. If you received unemployment.

If I paid taxes on unemployment benefits will I get a refund. The most recent batch of unemployment refunds went out in late July 2021. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

These automatic payments will be a refund of the taxes paid on up to 10200 of. Will I receive a 10200 refund. Hi all My mom paid taxes on her Covid payments during 2020 BEFORE they changed the law.

The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received. Here is more information about unemployment tax. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in.

1 it sent another round. The tax rate for a start-up entrepreneur is 10 for the first year of liability 11 for the second year of liability and 12. People might get a refund if they filed their returns.

2Americans who overpaid in taxes on unemployment benefits received in 2020 could be getting a refund. Efile your tax return directly to. September 9 2021 1214 PM.

The IRS is sending another 15 million refunds to people who were taxed on unemployment income last year before a portion of the benefits were made tax-free the. Tax refunds on unemployment benefits to start in May. Refunds set to start in May.

Taxpayers can expect to receive a refund of 1265 on average. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. The IRS has issued. You would be refunded the income taxes you paid on 10200.

What are the unemployment tax refunds. Updated March 23 2022 A1. For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of.

This batch totaled 510 million with the.

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

Unemployment Tax Refund 169 Million Dollars Sent This Week

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

Irs Sending Refunds To Millions Who Paid Unemployment Taxes Tax Alpha Cpa

Unemployment Benefits In Ohio How To Get The Tax Break

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Stimulus Check Update When Will Plus Up Covid Payments Arrive

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

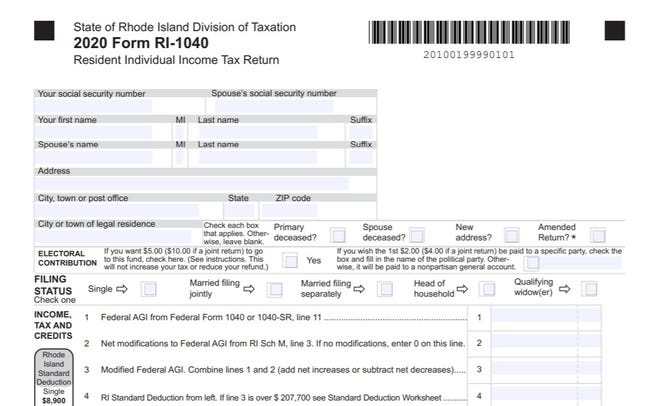

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

When Will Irs Send Unemployment Tax Refunds 11alive Com

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7

Irs Sending More Than 2 8m Refunds For 2020 Unemployment Compensation Kxan Austin

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits